According to new data shared by the Real Estate Institute of Australia, the value of Adelaide units has climbed faster than houses over the past three decades, however surprisingly housing prices in Adelaide have surpassed unit prices in the past 3 months (source: The Advertiser 19th Feb 2021).

Unit Prices By Capital City Sept 1990 Vs 2020

| UNITS | Sept 1990 | Sept 2020 | Rise |

| Melbourne | $113,500 | $622,500 | 448% |

| Sydney | $138,200 | $732,400 | 430% |

| Hobart | $77,000 | $403,500 | 424% |

| Canberra | $95,000 | $480,000 | 405% |

| Adelaide | $81,500 | $410,500 | 404% |

| Perth | $74,700 | $375,000 | 402% |

| Brisbane | $92,200 | $394,500 | 328% |

| Darwin | N/A | $300,000 | N/A |

As per the data shown above, Adelaide’s median unit price has soared from $81,500 to $410,500, which is a 404% jump in the past 30 years.

During the same period, house values have jumped from $105,000 to $495,000 – a 371% increase.

CoreLogic’s data indicates that buying an investment property in Adelaide continues to be an excellent long term and secure choice for many.

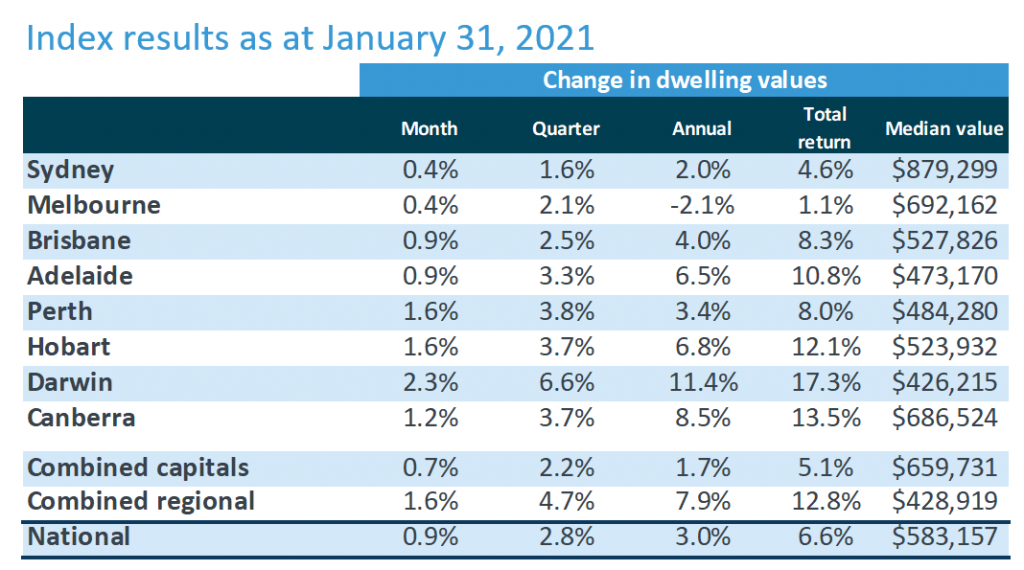

Change In Dwelling Values By Capital City

Nationwide, capital cities’ median house prices have increased an average of 453%, while unit prices have climbed 405%.

House Prices By Capital City Sept 1990 Vs 2020

The table below shows cities that top the charts in the housing market.

| HOUSES | Sept 1990 | Sept 2020 | Rise |

| Sydney | $173,000 | $1.15MI | 565% |

| Melbourne | $137,000 | $846,000 | 518% |

| Hobart | $88,000 | $545,000 | 519% |

| Canberra | $120,000 | $730,000 | 508% |

| Brisbane | $106,000 | $539,000 | 408% |

| Perth | $95,000 | $480,000 | 405% |

| Adelaide | $105,000 | $495,000 | 371% |

| Darwin | $110,000 | $480,000 | 336% |

In terms of house price growth, Sydney is at the top. Between 1990 and 2020, it witnessed an increase of 565% from $173,000 to $1.15M.

Additionally, Melbourne units saw price appreciation of 448% from $113,500 to $622,500.

Brisbane received a jump of 408% as the median house price rose from $106,000 to $539,000. Additionally, unit prices grew by 328%.

Since the 1990s, Hobart’s property market observed tremendous growth, with the price up from $88,000 to $539,000 – a 519% increase making it the second-fastest-growing market in Australia.

According to the experts, the surge in Adelaide’s real estate market is receiving much attention. Not even the pandemic could diminish the demand growth and or the price increases.

Securing Your Future

Currently, SA, especially Adelaide’s property market, is one of the hottest investment options, property investors who are looking for good ROI over the long term are now taking advantage of the low interest rates to buy investment property and secure their retirements.

Ultimately smart property investment is still a fantastic option for many South Australians who want to secure their futures, prepare for retirement and leave a lasting legacy for their families.

If you are wanting to get started as a property investor or simply just want to review what you’re currently doing then contact us today for a Free Strategy Session. With our wide range of services we can help you to calculate how much you can borrow, set investment goals, structure your mortgage for long term success, minimise tax and much more.

Talk Soon.

Martin Langton

Business Manager and Registered Land Agent

Ph: (08) 8263 4009

Mob: 0455 500 262