Join the club!

Not a member yet? Register Now

Already a member? Login Now

Login to your account

Register to start learning

My Cart 0

Not a member yet? Register Now

Already a member? Login Now

Despite all the challenges we experienced in the last couple of years and a sequence of lockdowns, the housing market in Australia encountered a once in a generation boom in real estate prices in 2021.

And yet the pace of house price boost is slowing, and APRA (Australian Prudential Regulation Authority) is willing to see housing markets slow down, property values growing every market around the country.

We came across many potential buyers asking will the housing market crash in 2022? How long can this last?

It means not all locations will continue developing strongly moving forward. Moreover, many experts speculated that properties in inner and middle-ring suburbs notably outperform more affordable properties in outer suburbs.

While the cheaper end of the markets and outer suburban have performed firmly so far, affordability is becoming a concern as the locals have had the lowest wages growth when housing market prices have boomed.

It is projected there will be an increased emphasis on quality properties and liveability.

The property’s value will keep growing in 2022, though not everywhere and not to the same upward slope as they have over the last couple of years.

We are steering towards robust economic growth, high consumer and business confidence, creating more jobs.

In a nutshell, it is far-fetched that we will continue to witness the same growth rate over the next two years that we have seen over the past couple of years.

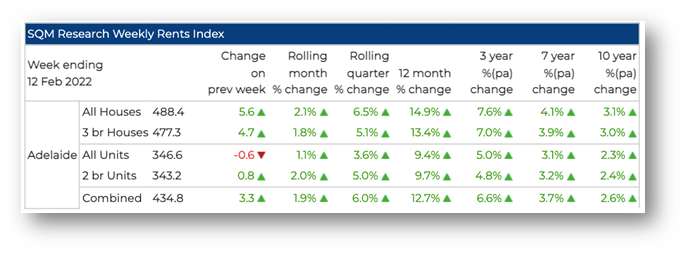

Rentals continue to rise throughout 2022 due to meagre vacancy rates and increased rental demands.

Despite the lack of immigration, the following stats indicate how the rentals rose.

And, as growing house rentals will make affordability issues for several tenants, apartment rentals will also rise in 2022.

The real estate market will maintain a substantial supply of homes. Australians will be spending their funds differently than in the last two years, which inspired people to sell, renovate and upgrade their property and in due course, interest rates will grow.

Whether the housing market will just experience stop dead or slower growth in the tracks will base on what actions are introduced.

☑ Family Budgeting

☑ Set Investment

Goals

☑ Mortgage Structuring

☑ Calculate how much you can borrow

☑ Property Sourcing

☑ RP Data Reports

☑ Property Investment Analysis

☑ Co-ordinate Process

☑ Discounted building inspection

☑ Discounted conveyancer

✓ More than 14 years of experience in finance

✓ Over $100 million in loans written

✓ Investment property specialists

✓ Panel of builders that offer fixed price, turn key packages for investors

✓ We help investors build equity and avoid over-paying tax

☑ Calculate how much you can borrow

☑ Set Investment

Goals

☑ Mortgage Structuring

☑ Property Sourcing

☑ RP Data Reports

☑ Property Investment Analysis

☑ Budgeting

☑ Co-ordinate Process

☑ Discounted building inspection

☑ Discounted conveyancer