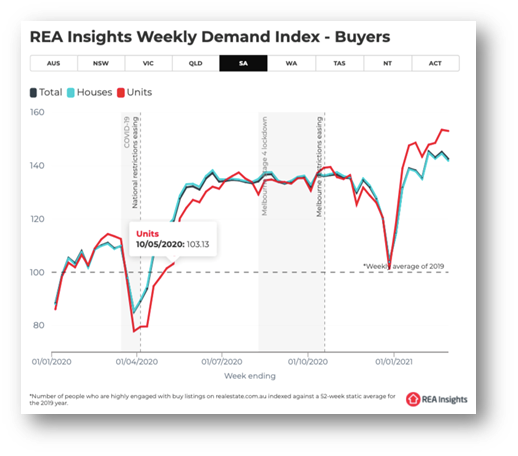

Amid the market volatility, some cities continue to reel, while others have picked up swiftly thanks to a combination of state & local policies as well as demographic and economic factors.

According to property experts, South Australia’s cosmopolitan coastal capital Adelaide is among those showing signs of growth.

Adelaide shows excellent potential for investors who want to buy and hold

For me, there are many great reasons to consider Adelaide and its suburbs as a potential investment hotspot in 2021.

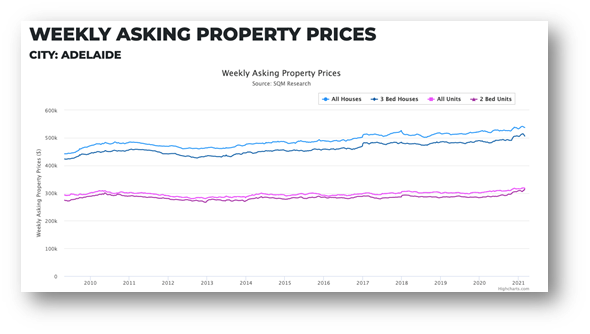

Most Consistent Property Market

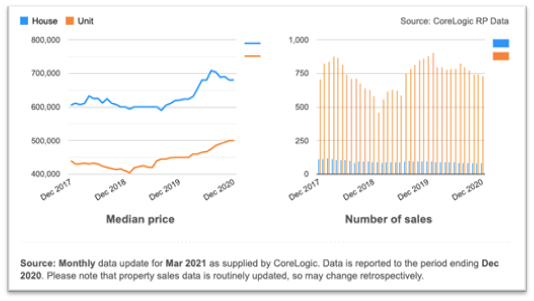

Historical data suggests that it continues to perform at a very stable level. Compared with Sydney, Melbourne, Brisbane and Perth, Adelaide is more affordable with strong projected growth. While analysing the charts, I don’t see tremendous lows, or enormous highs.

It is one of the top reasons why Adelaide is a perfect choice for long-term investments. Please refer to the below Property prices chart.

On top of that, the low-interest rate, improving economic conditions and quick response to control the COVID-19 situation make Adelaide one of the most sought-after options among property investors.

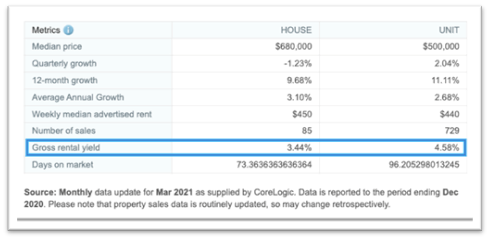

The median house price is $680,000, and the median unit price is $500,000, making Adelaide one of the most affordable places in the country.

Adelaide House price: Annual capital growth 3.10%, Median price of $680,000, Weekly median advertised rent $450.

Adelaide Unit price: Annual capital growth 2.68%, Median price of $500,000, Weekly median advertised rent $440.

If cash flow is your primary objective, buying an investment property in Adelaide might be your best bet.

Rental yields are not only strong, but they have improved steadily with time and are set to stay on that trajectory.

- The gross rental yield for houses is 3.44%.

- The gross rental yield for units is 4.58%.

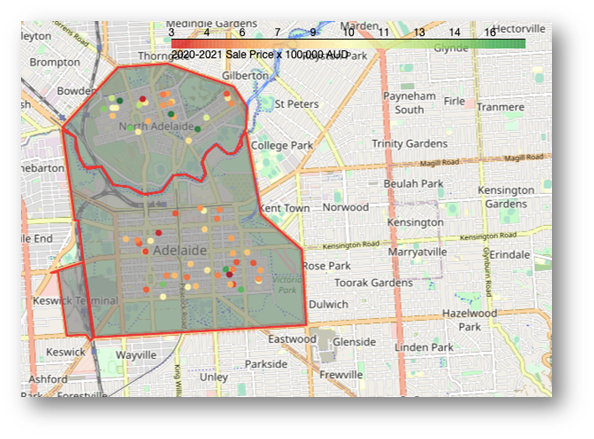

Best Suburbs To Invest In Adelaide In 2021

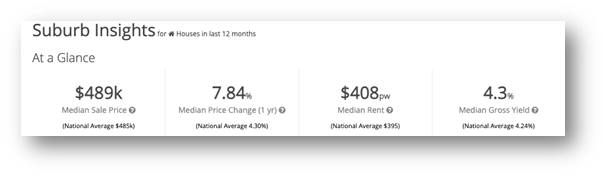

1. Greenacres, SA 5086

It is a north eastern suburb of Adelaide, SA in the City of Port Adelaide Enfield. Property investors have seen a 4.38% gain in Greenacres based on an increase in median home prices for the past three months. (source: realestateinvestar.com.au).

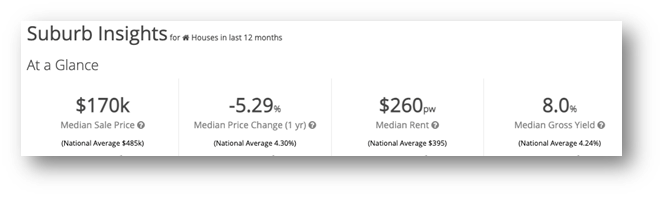

2. Elizabeth North, SA 5113

It is a northern suburb of Adelaide. The median rent in Elizabeth North for houses is $260 per week. Stock on the market for townhouses/houses has changed -15.56% compared to last year (source: realestateinvestar.com.au).

3. Munno Para, SA 5115

It is a suburb in the Playford Region of SA. The median rent in Munno Para for houses is $318 per week and the median gross yield is 6.1%.

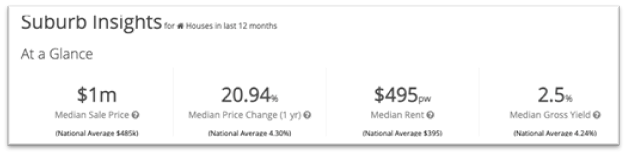

4. Norwood, SA 5067

It is a well-know and cosmopolitan suburb of Adelaide, about four km east of the Adelaide city centre. The capital gain property investors experienced for this SA suburb was 19.39%. (source: yourinvestmentpropertymag.com.au)

5. Salisbury East, SA 5109

It is a peaceful, affordable suburb near Brahma Lodge, Salisbury Heights and Para Hills.

TWO-CENTS WORTH

Adelaide’s growing property market has a lot to offer investors. It offers reliable and steady long term growth. While capital growth and rental yields are more modest than on the east coast, at the same time, they are less volatile.

As with any investment decisions, your situation will dictate what is most appropriate for you. Besides, Adelaide has shown itself to be capable of withstanding the pandemic situation and economic shock, making real estate here one of the safest investment options.

Let’s have a quick chat (on 0435 856 649) or send me an online enquiry to discuss your options and goals before making a final decision.

Steve Barker

Ph: (08) 8263 4009

Mob: 0435 856 649