Before 2021, there was a sense of confusion about how SA’s property market might fare. There sure were a lot of overwhelming forecasts!

With the South Australian capital city of Adelaide among those showing signs of exceptional growth.

The mismatch between supply and demand is the core factor pushing house prices higher and buyers seeking to make the most of the record-low interest rates.

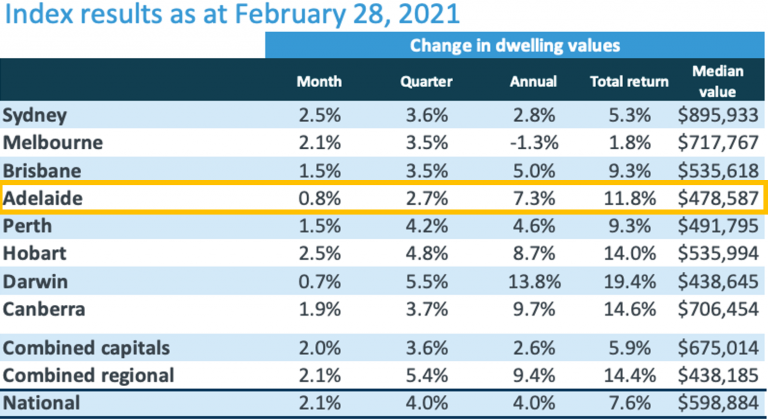

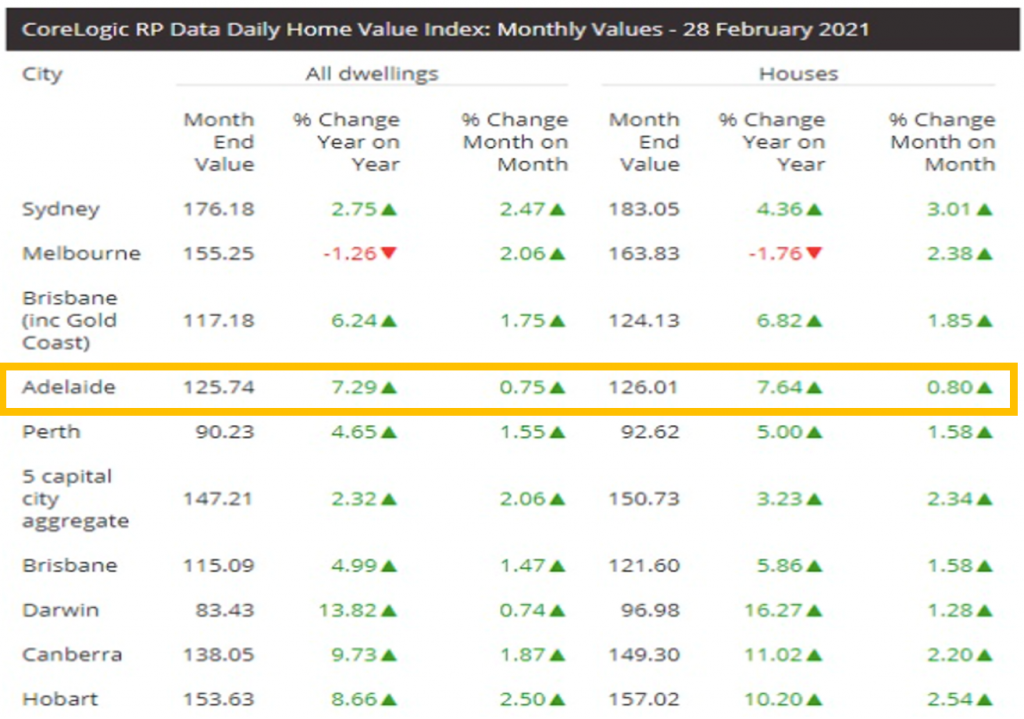

In the past 12 months, the city’s combined unit and median house price jumped to $478,587 (+7.3%).

According to CoreLogic’s latest Hedonic Home Value report, this was almost three times the (2.7%) combined rate for all capital cities.

Is Now A Good Time To Invest?

Adelaide exhibits much potential for investors who want to buy and hold. It is still considered a property market that connects affordability & livability with long-term growth consistency.

Now is the time to take action and prepare yourself for the opportunities that will manifest themselves as the property market moves on. As always, speak to a seasoned property advisor about your particular circumstances before diving into any investment property purchase.

Top Reasons to Buy Investment Property in Adelaide

Reason 1: The Market Is Very Positive

The scenario of FOMO (Fear of Missing out) is one of the biggest reasons contributing to rising property prices. People are not waiting for other people to catch up, and they are not waiting for auctions.

According to the report, Adelaide’s house values were up 7.6% compared to this time last year and 3.1% for the past quarter. And Metro units were influential performers – up 5.2% for the year.

Reason 2: Average Rent In Adelaide Are At Its Best Since 2010

The long-term rental market remains resilient with a decreasing supply of dwellings and vacancy rates plunging swiftly since April 2020.

According to the Domain Rental Report, in Adelaide, the average rent was the highest since 2007 for units while house rentals were at their best since 2010.

Rental property demand is mostly coming from the younger working crowd.

The accessibility to employment nodes makes Adelaide and its suburbs an excellent choice to buy an investment property.

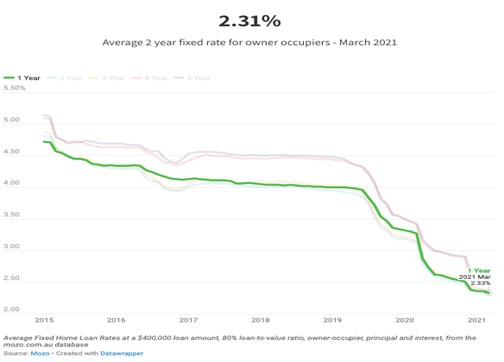

Reason 3: Home Loan Interest Rates Are At A Historically Low-Level

February was quite a month for home loans, but there was still room for activity, mostly fixed rates.

Additionally, buyers can take out home loans at such low rates, the competition for the restricted supply of homes is warming up.

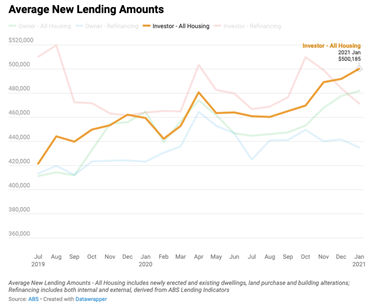

Reason 4: Housing Loan Approvals Surge

According to the latest reports, loan approvals are now 49.3% higher than pre-COVID levels. At the same time, investor loans for all housing have also increased.

These robust financial figures imply that these house prices will continue to climb over the coming months.

We’re Here To Help You

If you’re bewildered about the mixed communications in the media, you are not alone.

We’re here to help you identify the best suburbs to invest in based on your specific situation.

Be it fresh ideas, leveraging our industry connections or a finance sounding board.

We’re always open for a chat about how we can help grow your wealth.

Contact Us today for a Free Strategy Session!